Your plan will provide different coverage for different services, as explained in your Schedule of Benefits. To understand the information in your Schedule of Benefits, you will need to know these terms:

Deductible:

The amount you owe for covered health care services before your health plan will begin to pay. For example, if your deductible is $1,000, your plan won’t pay anything until you’ve paid your $1,000 deductible for covered health care services that are subject to the deductible. The deductible may not apply to all services.

Coinsurance:

Once you meet your deductible, your plan will pay for a percentage of your health care services and you will pay the balance.

Copayment (copay):

This is a fixed fee you must pay for a covered health care service, usually at the time you receive the service. Copayments generally do not count toward the deductible.

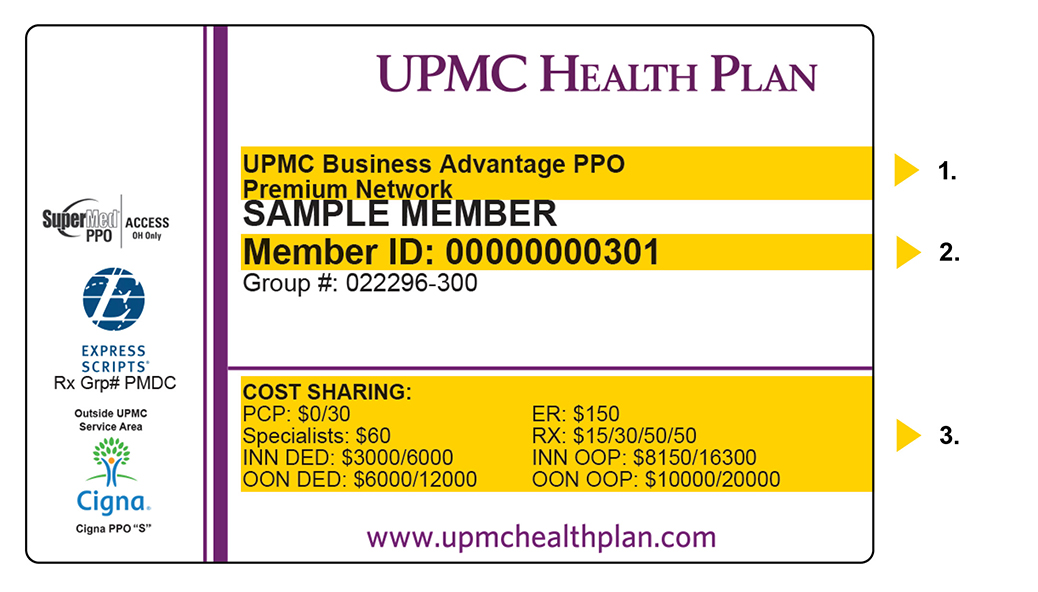

Your member ID card lists your copayment amounts for common services. Keep in mind that these amounts vary by service type. For full details of your plan, view your Schedule of Benefits on the UPMC Health Plan member site.

- Doctors may ask for this information to ensure that they participate in your network.

- You’ll need this number to complete medical forms.

- These are your cost-sharing amounts. They vary by service type.

Out-of-pocket limit or maximum:

This is the most you will pay during a policy period (usually a year) before your health insurance plan will pay 100 percent of the allowed amount. This limit never includes your premium, balance-billed charges, or health care your insurance plan doesn’t cover. Some health insurance plans don’t count all of your copayments, deductibles, coinsurance payments, out-of-network payments, or other expenses toward this limit. You can learn your out-of-pocket maximum on the UPMC Health Plan member website.

How does it work?

If your plan includes spending account options and you open an account, you can use it to pay for qualifying expenses.

Understand your premium

A premium is the specific amount that is charged to covered groups and individuals for health care coverage. An individual or their employer normally pays this monthly.

- Enrolled for coverage through your employer? You will pay your share of the cost through a payroll deduction.

- Purchased insurance coverage on your own? Learn how to pay your monthly bill.

Learn about your costs

- Your Schedule of Benefits explains what services are covered under your plan and at what cost share.

- You can estimate what your portion of a medical procedure will be by using our medical cost estimator on the UPMC Health Plan member site.

- Your Prescription Drug Rider (if applicable) lists your benefit limits and cost-sharing amounts for prescription medications. It also tells you if you will have to pay a deductible.

- Your Explanations of Benefits (EOBs) provide information about what you and your covered family members have paid during the plan year toward your out-of-pocket maximum.

- You can review your member guide to get an understanding of how your plan works. Whether you are a new or returning member, it's important to take a few minutes to review your guide. We update it each year, and the information it contains will help you take control of your health and your health care expenses.

This helpful guide will tell you how (and why) you should:- Download the UPMC Health Plan app.

- Take the MyHealth Questionnaire.

- Find a provider/select your primary care provider.