Your plan will provide different coverage for different services, as explained in your Schedule of Benefits. To understand the information in your Schedule of Benefits, you will need to know these terms:

Deductible:

The amount you owe for covered health care services before your health plan will begin to pay. For example, if your deductible is $1,000, your plan won’t pay anything until you’ve paid your $1,000 deductible for covered health care services that are subject to the deductible. The deductible may not apply to all services.

Coinsurance:

Once you meet your deductible, your plan will pay for a percentage of your health care services and you will pay the balance.

Copayment (copay):

This is a fixed fee you must pay for a covered health care service, usually at the time you receive the service. Copayments generally do not count toward the deductible.

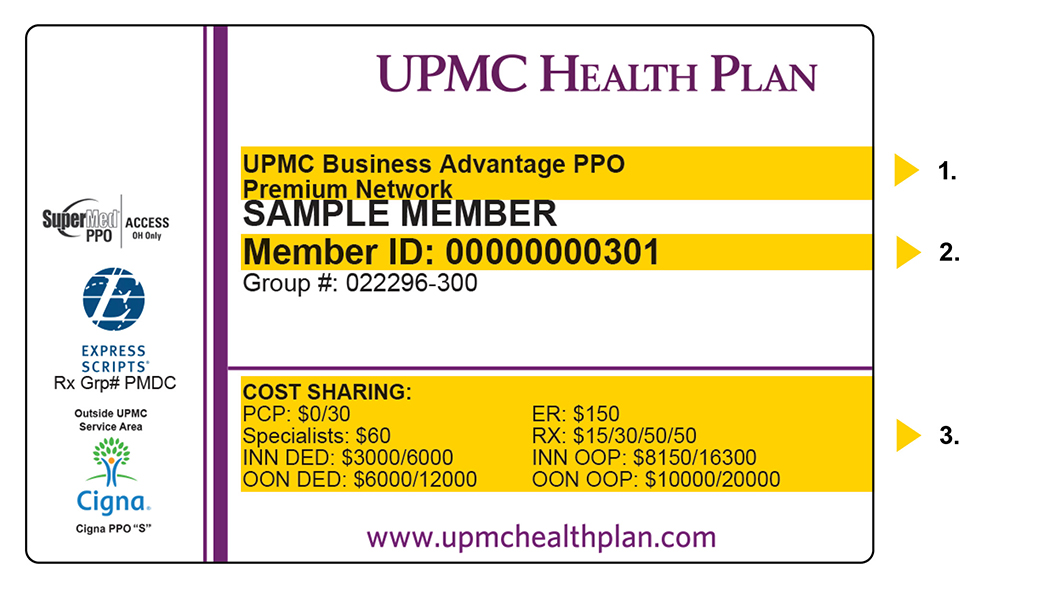

Your member ID card lists your copayment amounts for common services. Keep in mind that these amounts vary by service type. For full details of your plan, view your Schedule of Benefits on MyHealth OnLine.

- Doctors may ask for this information to ensure that they participate in your network.

- You’ll need this number to complete medical forms.

- These are your cost-sharing amounts. They vary by service type.

Out-of-pocket limit or maximum:

This is the most you will pay during a policy period (usually a year) before your health insurance plan will pay 100 percent of the allowed amount. This limit never includes your premium, balance-billed charges, or health care your insurance plan doesn’t cover. Some health insurance plans don’t count all of your copayments, deductibles, coinsurance payments, out-of-network payments, or other expenses toward this limit. You can learn your out-of-pocket maximum on MyHealth OnLine.