When can you sign up for Medicare?

At set times during the year, you can enroll in or change your Medicare plan. Your enrollment timeline depends on whether you're enrolling in Medicare for the first time or changing your coverage.

There are five key enrollment periods for Medicare:

Jump to a section:

- Initial Enrollment Period

- General Enrollment Period

- Medicare Advantage Open Enrollment Period

- Annual Enrollment Period

- Special Enrollment Period

New to Medicare?

| 6 months before your birthday | Start doing research on Medicare Advantage plans. Research which companies offer Medicare coverage in your area. Decide which type of plan will best meet your health care needs. |

|---|---|

| 5 months before your birthday | Attend a community meeting about Medicare. You'll learn about what Original Medicare covers, types of Medicare Advantage plans, and why Medicare Part D is important. |

| 3 months before your birthday | Sign up for Original Medicare. Enroll in Medicare Parts A and B. Sign up for Medicare Advantage coverage. Make sure you apply for enrollment three months before your birthday. This ensures you don't have a gap in health care coverage. |

| 3 months after your birthday | This month is the last month you can enroll in Original Medicare. |

Initial Enrollment Period

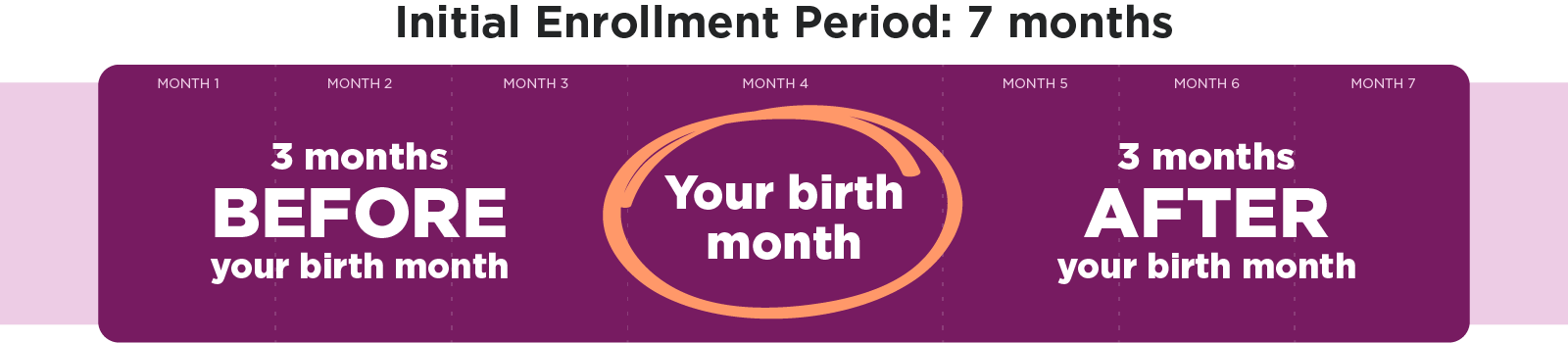

When you are new to Medicare, you have an Initial Enrollment Period that allows you seven months to enroll in Medicare Parts A and B. This time frame includes:

- Three months before the month of your 65th birthday.

- The month of your 65th birthday.

- Three months after the month of your 65th birthday.

Understanding the right time to enroll is important. Not doing so could result in a delay in coverage, and you could face penalties later on. Use the New to Medicare Enrollment Timeline above to learn how you can prepare to enroll in Medicare for the first time.

Have questions about your Initial Enrollment Period?

Our licensed UPMC for Life Medicare Advisors can answer your questions and help you choose the Medicare plan that's right for you. Our team is here to give you the personal support you deserve. There are a number of ways to connect with someone in person or online to learn more about UPMC for Life. Call us at 1-844-575-8241 (TTY: 711).

How to sign up for Original Medicare

Contact the Social Security Administration to sign up for Original Medicare. Call 1-800-772-1213 Monday through Friday from 8 a.m. to 7 p.m. TTY users should call 1-800-325-0778.

General Enrollment Period (GEP)

If you did not apply for Original Medicare during your Initial Enrollment Period and were not automatically enrolled, you can still sign up during the Medicare General Enrollment Period. From Jan. 1 to March 31, you can sign up for Medicare Parts A and Part B. Your coverage will begin July 1. Please note that you may have to pay a late enrollment penalty.

Already on Medicare?

You can change your Medicare Advantage coverage only during certain times of the year.

| Annual Enrollment Period: Oct. 15 – Dec. 7 |

You can add or drop Part D prescription drug coverage, change to a Medicare Advantage plan, or change to Original Medicare. Your coverage will be effective Jan. 1. |

|---|---|

| Special Enrollment Period: Varies |

You can change your Medicare coverage following a qualifying life event. Your coverage will be effective the first of the next month. |

| Open Enrollment Period: Jan. 1 – March 31 |

If you are on a Medicare Advantage plan, you can make ONE change to your coverage. You can add or drop Part D prescription drug coverage or change to a different Medicare Advantage plan or to Original Medicare. Your coverage will be effective the first of the next month. |

| Lock-in Period: April 1 – Oct. 14 Dec. 8 – Dec. 31 |

You cannot make a plan change after March 31 unless you qualify for a Special Election Period (SEP) or have Medical Assistance coverage. |

Medicare Advantage Open Enrollment Period (MA OEP)

If you are already enrolled in a Medicare Advantage plan, you can make changes to your coverage during certain times of the year. The Medicare Advantage Open Enrollment Period runs from Jan. 1 to March 31, and changes begin the first day of the following month.

During MA OEP you can:

- Change to another Medicare Advantage plan. You can choose a plan with or without Part D drug coverage.

- Change back to Original Medicare. If you choose to leave your Medicare Advantage plan and go back to Original Medicare, you can also join a standalone Part D drug plan.

There are some limitations to what changes you can make during this period:

- You can make only ONE change during this period.

- You cannot change from Original Medicare to a Medicare Advantage plan.

- You cannot join a Medicare Part D drug plan if you are on Original Medicare, but you can if you are changing from a Medicare Advantage plan to Original Medicare.

Medicare Annual Enrollment Period (AEP)

The Medicare Annual Enrollment Period (AEP) is the time each year when Medicare members can review and make changes to their Medicare coverage. This period runs from Oct. 15 to Dec. 7. Changes made to your coverage will start Jan. 1.

During AEP you can:

- Change from Original Medicare (Part A and Part B) to a Medicare Advantage plan (Part C).

- Change from a Medicare Advantage plan back to Original Medicare.

- Change from one Medicare Advantage plan to another.

- Enroll in or drop a Medicare Part D prescription drug plan.

Special Enrollment Period (SEP)

A Special Enrollment Period is a time outside of regular enrollment periods when you can make changes to your Medicare coverage due to certain life events. The length of your SEP depends on the reason for SEP. You typically have 60 days from the qualifying event or eight months after employer health coverage ends.

Common situations that qualify for a Special Enrollment period include:

- Loss of existing coverage. If you or your spouse lose your employer health coverage or you retire, you can enroll in Medicare without facing enrollment penalties.

- Moving. If you move out of your current plan’s service area, you can change to a different Medicare Advantage plan or Prescription Drug plan that covers your new location.

- Eligibility for Extra Help. If you become eligible for Extra Help with Medicare drug costs, you can add or drop a Medicare Part D plan.

- Qualifying for Medicaid. If you gain, lose, or have a change in your Medicaid eligibility, you can make changes to your Medicare coverage.

- Nursing home and long-term care facility residents. If you move into, live in, or leave a nursing home or long-term care facility, you can make changes to your Medicare Advantage plan or Medicare Part D plan.

- 5-star plan enrollment. You can make one change to enroll in a plan that has a 5-star overall performance rating. You can switch from a Medicare Advantage plan, Original Medicare, or a Part D prescription drug plan as long as the new plan has a 5-star rating.

- Other special situations. Other circumstances, like becoming eligible for a Special Needs Plan (SNP) or if your current plan has changed, you can also qualify for a SEP.

Exploring the different parts of Medicare and their coverage

Medicare resources

View MoreThis information is not a complete description of benefits. Call 1-866-400-5077 (TTY: 711) for more information. Out-of-network/Noncontracted providers are under no obligation to treat UPMC for Life members, except in emergency situations. Please call our customer service number or see your Evidence of Coverage for more information, including the cost sharing that applies to out-of-network services. Other physicians/providers are available in the UPMC for Life network.

This information is available for free in other languages. Please call our customer service number at 1-877-539-3080 (TTY: 711).

UPMC for Life has a contract with Medicare to provide HMO, HMO D-SNP, and PPO plans. The HMO D-SNP plans have a contract with the PA State Medical Assistance program. Enrollment in UPMC for Life depends on contract renewal. UPMC for Life is a product of and operated by UPMC Health Plan Inc., UPMC Health Network Inc., UPMC Health Benefits Inc., UPMC for You Inc., and UPMC Health Coverage Inc.

SilverSneakers is a registered trademark of Tivity Health Inc. SilverSneakers GO is a trademark of Tivity Health Inc. © 2025 Tivity Health Inc. All rights reserved.

UPMC for Life Members

Call us: 1-877-539-3080

TTY: 711

Oct. 1 – March 31:

Seven days a week from 8 a.m. to 8 p.m.

April 1 – Sept. 30:

Monday through Friday from 8 a.m. to 8 p.m.

UPMC for Life Prospective Members

Call us: 1-866-400-5077

TTY: 711

Oct. 1 – March 31:

Seven days a week from 8 a.m. to 8 p.m.

April 1 – July 31:

Monday through Friday from 8 a.m. to 8 p.m.

Aug. 1 – Sept. 30:

Monday through Friday from 8 a.m. to 8 p.m. Saturday from 9 a.m. to 3 p.m.

Y0069_260014

Last Updated: 10/1/2025